Get a Free Car Insurance Quote from USAA

Free car insurance quote USAA sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. USAA, a renowned financial services provider, offers a wide range of insurance products tailored specifically for military families and veterans. USAA's commitment to serving this unique demographic has earned it a reputation for excellence and customer satisfaction.

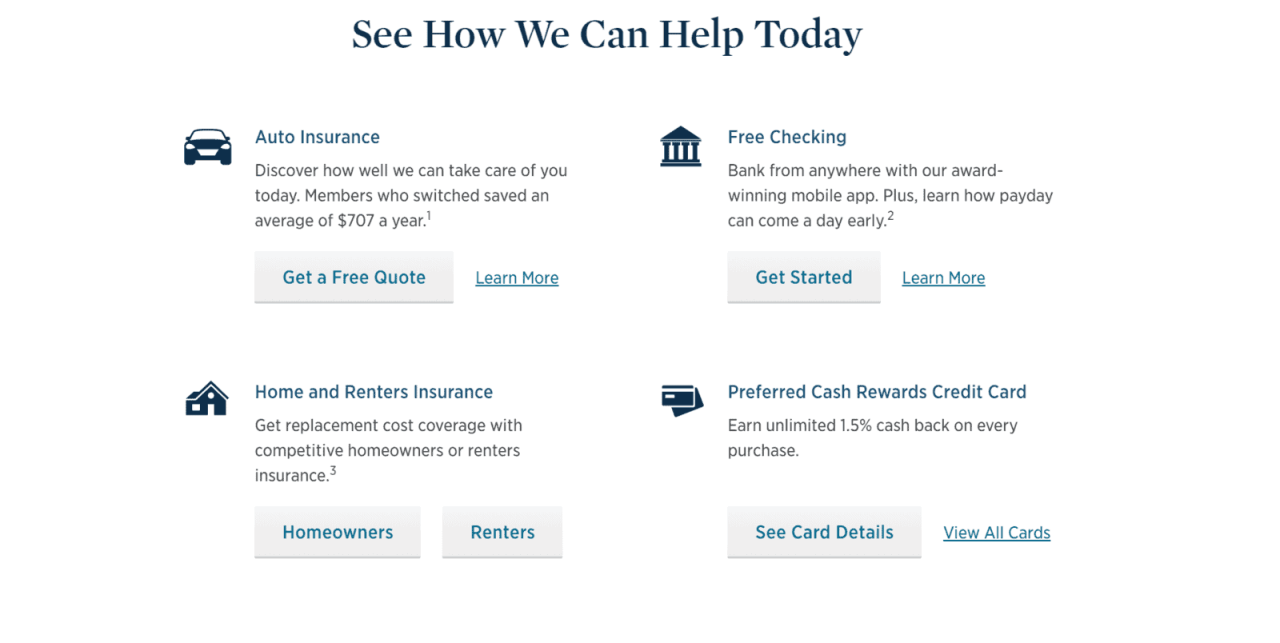

One of the most valuable services USAA provides is its free car insurance quote tool. This online tool allows potential customers to quickly and easily obtain a personalized quote for car insurance coverage, without any obligation. The quote process is simple and straightforward, requiring only basic information about the vehicle and driver. USAA then uses this information to generate a customized quote, reflecting the individual's specific needs and risk profile.

USAA Overview

USAA, short for United Services Automobile Association, is a well-respected financial services company serving military families and their loved ones. It's a member-owned organization with a rich history and a strong commitment to providing financial solutions that cater to the unique needs of the military community.

History and Mission, Free car insurance quote usaa

USAA was founded in 1922 by a group of Army officers in San Antonio, Texas. These officers wanted to provide affordable and reliable insurance to fellow military personnel who often faced challenges securing coverage due to their frequent relocations and deployments. Over the years, USAA has grown significantly, expanding its services to include banking, investment, insurance, and other financial products. The company's mission remains steadfast: to facilitate the financial security of military families and their loved ones.Target Audience and Membership Requirements

USAA's target audience primarily comprises active-duty military personnel, veterans, their families, and eligible dependents. To become a USAA member, individuals must meet specific eligibility criteria, which typically include:- Current or former service in the U.S. military (including active duty, National Guard, Reserves, and certain retired personnel)

- Spouse or surviving spouse of a qualifying service member

- Dependent children of a qualifying service member

USAA's Unique Value Proposition for Military Families

USAA has established itself as a trusted financial partner for military families by offering a range of benefits and services tailored to their specific needs. These benefits include:- Competitive rates and discounts: USAA often provides lower insurance premiums and discounts for military members, recognizing their unique circumstances and potential for risk.

- Specialized coverage options: The company offers insurance products designed for military families, such as coverage for deployed vehicles, military equipment, and overseas property.

- Excellent customer service: USAA is known for its exceptional customer service, with dedicated representatives who understand the challenges faced by military families and are equipped to provide personalized support.

- Financial planning resources: USAA provides tools and resources to help military families plan for their financial future, including financial planning advice, budgeting tools, and retirement planning assistance.

Free Car Insurance Quote Process: Free Car Insurance Quote Usaa

Information Required for a Quote

To generate an accurate car insurance quote, USAA will need some basic information about you and your vehicle. This information helps them assess your risk profile and determine the appropriate coverage and premium.- Personal Information: This includes your name, address, date of birth, and contact information. You will also need to provide your Social Security number to verify your identity and access your driving history.

- Vehicle Information: You will need to provide details about your vehicle, such as the make, model, year, and vehicle identification number (VIN). USAA will also want to know if you have any modifications to your car, such as a custom paint job or aftermarket parts.

- Driving History: USAA will need to access your driving record, which includes information about any accidents, tickets, or other violations you may have received. This information helps them assess your risk as a driver.

- Coverage Preferences: You will need to indicate the type and amount of coverage you desire. USAA offers a variety of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Factors Influencing Car Insurance Rates

Several factors influence your car insurance rates, and understanding these factors can help you make informed decisions to potentially lower your premium.- Driving History: Drivers with a clean driving record typically pay lower premiums than those with a history of accidents, tickets, or violations.

- Age and Gender: Younger and inexperienced drivers are statistically more likely to be involved in accidents, so they often pay higher premiums. Gender can also play a role, as men tend to have higher accident rates than women.

- Location: Car insurance rates can vary based on your location. Areas with higher traffic density or a higher rate of accidents may have higher premiums.

- Vehicle Type: The type of vehicle you drive can also affect your premium. Sports cars, luxury cars, and vehicles with high-performance engines are often more expensive to insure due to their higher risk of accidents.

- Credit Score: In some states, insurers can use your credit score as a factor in determining your car insurance rates. Individuals with good credit scores tend to pay lower premiums.

- Coverage Levels: The type and amount of coverage you choose can significantly impact your premium. Higher coverage limits typically result in higher premiums.

Whether you're a current or former member of the military, or simply looking for affordable and reliable car insurance, USAA is a company worth considering. Their dedication to serving military families, combined with their competitive rates and exceptional customer service, makes USAA a top choice for many drivers. By providing a free car insurance quote, USAA empowers individuals to make informed decisions about their insurance needs and find the best coverage for their unique circumstances.

Finding a free car insurance quote from USAA can be a smart move, especially if you're a military member or veteran. While you're taking care of your insurance needs, consider saving money on cooling your home this summer. You can find some great tips for making your own DIY air conditioner in this article: DIY Air Conditioner: Cool Down Your Home on a Budget.

Once you've got your home feeling comfortable, you can relax knowing you've got the right car insurance coverage with USAA.

Getting a free car insurance quote from USAA is a great first step in protecting your vehicle. While you're planning for the unexpected, why not also consider getting creative with your Halloween costume? Check out this guide for inspiration: DIY Costumes: A Guide to Creative Costuming. After all, a little bit of DIY can go a long way in making your Halloween memorable.

Once you've got your costume sorted, you can focus on finding the best car insurance rates with USAA.

Post a Comment