TN Car Insurance Quotes Finding the Best Coverage

TN car insurance quotes set the stage for this exploration, offering readers a glimpse into the world of Tennessee car insurance and how to find the best coverage at the right price. This guide delves into the crucial aspects of securing adequate car insurance in Tennessee, from understanding the state's requirements to navigating the buying process and finding the most suitable options for your specific needs.

Whether you're a new driver, a seasoned veteran, or someone looking for a better deal on your current policy, understanding the factors that influence car insurance quotes in Tennessee is essential. This guide will help you navigate the complexities of the car insurance market, empowering you to make informed decisions and secure the best coverage for your vehicle and your budget.

Understanding Tennessee Car Insurance Requirements

Driving a car in Tennessee requires you to have car insurance. It's not just a suggestion; it's the law. This insurance protects you and others in case of accidents, and failing to have it can result in serious consequences.

Minimum Car Insurance Coverage Requirements in Tennessee

Tennessee requires drivers to have the following minimum car insurance coverage:- Bodily Injury Liability: This coverage pays for medical expenses and lost wages of other people injured in an accident that you caused. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damage to other people's property in an accident that you caused. The minimum requirement is $15,000 per accident.

Penalties for Driving Without Insurance in Tennessee

Driving without car insurance in Tennessee can result in several penalties, including:- Fines: You can be fined up to $500 for driving without insurance.

- License Suspension: Your driver's license can be suspended for up to 30 days for a first offense and up to 6 months for subsequent offenses.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Court Costs: You may be required to pay court costs if you are found guilty of driving without insurance.

Common Car Insurance Coverages and Their Benefits

Here are some common car insurance coverages that you can consider:- Collision Coverage: This coverage pays for damage to your own vehicle in an accident, regardless of who is at fault. It's important to note that collision coverage typically has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. Like collision coverage, comprehensive coverage also typically has a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are injured in an accident caused by a driver who doesn't have insurance or doesn't have enough insurance to cover your damages. This coverage can be crucial, as it can help you pay for medical expenses, lost wages, and other damages.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of who is at fault. It's important to note that PIP coverage is optional in Tennessee.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault. It's a smaller coverage than PIP, and it typically has a lower limit.

Finding the Best Car Insurance Quotes in Tennessee

Finding the right car insurance policy in Tennessee can be a challenging task. There are many factors to consider, such as your driving history, the type of car you drive, and your coverage needs. You can get the best possible rates by using a few strategies and tools to compare quotes from different insurance providers.Tips for Getting Accurate and Competitive Car Insurance Quotes

It is crucial to provide accurate information when requesting car insurance quotes. This helps ensure that you receive quotes that reflect your actual needs and risk profile. Here are some tips to get accurate and competitive quotes:- Be honest and thorough with your information: Provide accurate details about your driving history, including any accidents, violations, or claims. Also, provide information about your car, such as the make, model, year, and mileage. Be honest about your driving habits, such as the average number of miles you drive annually and whether you primarily drive in urban or rural areas.

- Compare quotes from multiple insurers: Don't settle for the first quote you receive. Get quotes from at least three to five different insurance companies to ensure you're getting the best rates. You can use online comparison websites or contact insurers directly.

- Ask about discounts: Many insurance companies offer discounts for good driving records, safety features, bundling policies, and other factors. Inquire about these discounts to see if you qualify.

- Review your policy regularly: Your insurance needs may change over time. Review your policy at least once a year to ensure you still have the right coverage and that your premiums are competitive.

Step-by-Step Guide to Obtaining Quotes, Tn car insurance quotes

Follow these steps to obtain quotes from different insurance providers:- Gather your information: Before you start, gather the necessary information, including your driver's license number, vehicle identification number (VIN), and details about your driving history and car.

- Use online comparison websites: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from multiple insurers simultaneously. You can enter your information once, and the website will generate quotes from various providers.

- Contact insurance companies directly: You can also get quotes by contacting insurance companies directly through their websites, phone, or local agents. This allows you to ask specific questions and discuss your individual needs.

- Compare quotes carefully: Once you have received quotes from different insurers, carefully compare them based on factors like coverage, premiums, and customer service. Pay attention to deductibles, limits, and any additional fees or charges.

- Choose the best policy: Select the policy that offers the best value for your needs. Consider your budget, coverage requirements, and the insurer's reputation and customer service.

Popular Car Insurance Companies in Tennessee

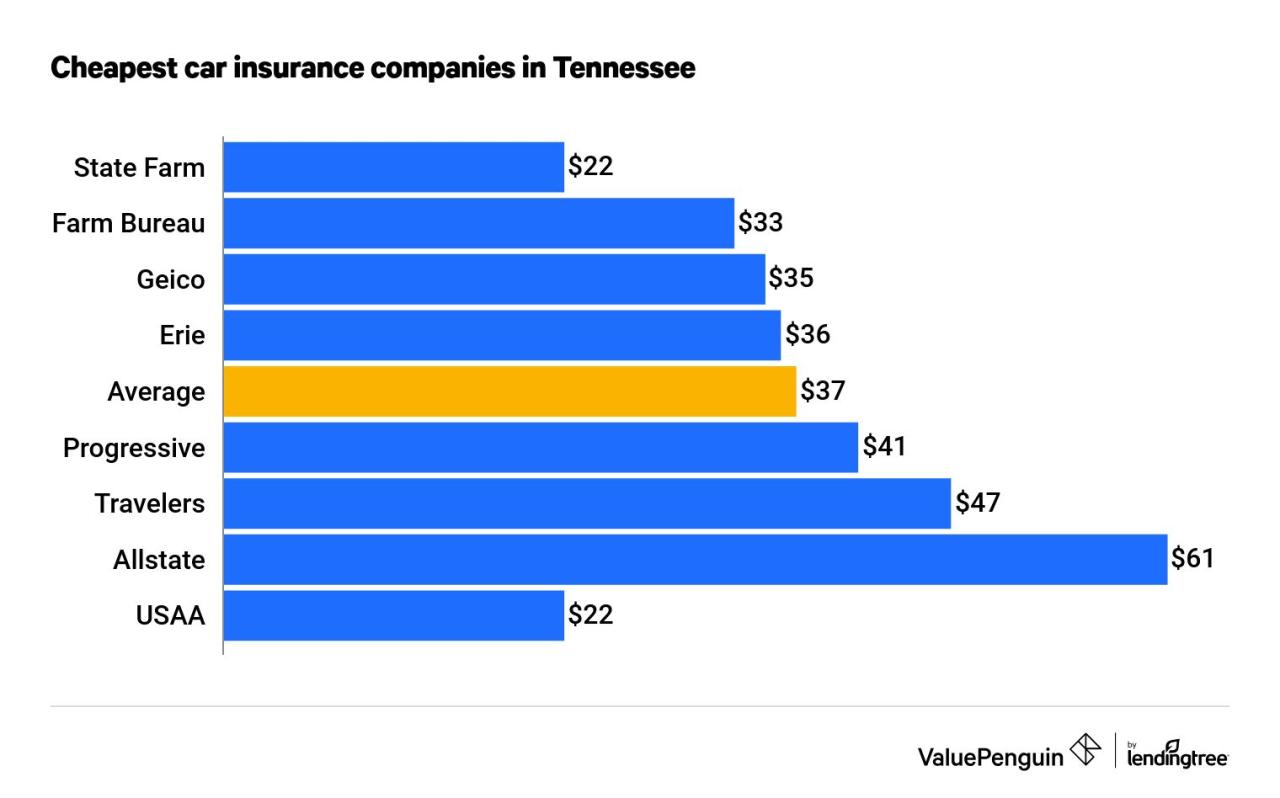

Here is a table comparing popular car insurance companies in Tennessee based on factors like coverage, pricing, and customer service:| Company | Coverage Options | Pricing | Customer Service |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments Coverage (MedPay) | Generally competitive, with discounts available | Highly rated for customer satisfaction |

| Geico | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments Coverage (MedPay) | Often offers lower premiums | Good customer service, but some complaints about claims handling |

| Progressive | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments Coverage (MedPay) | Competitive pricing, with a focus on customization | Mixed customer service reviews, with some complaints about claims handling |

| Allstate | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments Coverage (MedPay) | Pricing varies depending on factors like driving history and location | Generally positive customer service reviews |

| USAA | Comprehensive, Collision, Liability, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments Coverage (MedPay) | Competitive rates, especially for military members and their families | Highly rated for customer satisfaction and claims handling |

Note: This table provides general information and may not reflect the specific rates and coverage options available to you. It is always recommended to get personalized quotes from multiple insurance companies.

Understanding Car Insurance Discounts in Tennessee

Car insurance discounts are a fantastic way to save money on your premiums in Tennessee. By taking advantage of these discounts, you can significantly reduce your overall costs while maintaining adequate coverage. Let's explore some of the most common discounts available in Tennessee.Safe Driving Discounts

Safe driving discounts are often offered to drivers with a clean driving record. These discounts are a reward for responsible driving habits and demonstrate a commitment to safety on the road. To be eligible for this discount, you typically need to meet specific criteria, such as:- No accidents or violations: A spotless driving record with no accidents or traffic violations is a primary requirement.

- Years of safe driving: Some insurers may offer discounts based on the number of years you've driven without any incidents.

- Defensive driving courses: Completing a defensive driving course can also qualify you for a discount. These courses teach you safe driving practices and can demonstrate your commitment to road safety.

Good Student Discounts

Good student discounts are specifically designed for students who maintain excellent academic performance. These discounts are meant to encourage and reward academic achievement, recognizing the responsible behavior often associated with high-achieving students. To qualify for this discount, you generally need to:- Maintain a certain GPA: A minimum GPA is typically required, which can vary depending on the insurance company.

- Be enrolled in school: You must be actively enrolled in a recognized educational institution, such as high school, college, or university.

- Provide proof of grades: You'll usually need to provide your school transcripts or a letter of verification from your educational institution.

Multi-Car Discounts

Multi-car discounts are a great way to save money if you insure multiple vehicles with the same insurance company. This discount recognizes the reduced risk associated with insuring several vehicles from the same household. To be eligible for this discount, you must:- Insure multiple vehicles: You need to have at least two vehicles insured with the same insurance company.

- Insure vehicles under the same policy: All insured vehicles must be listed under the same policy.

- Meet eligibility requirements: Each vehicle must meet the insurance company's eligibility criteria for the discount.

Navigating the Car Insurance Buying Process in Tennessee

Steps in the Car Insurance Buying Process in Tennessee

The car insurance buying process in Tennessee involves several key steps, each with its own considerations.- Gather Information: Start by gathering essential information about your vehicle, driving history, and personal details. This includes your driver's license number, vehicle identification number (VIN), and information about any previous accidents or violations. This information helps insurance companies assess your risk profile and determine your insurance premiums.

- Compare Quotes: Once you have gathered the necessary information, you can start comparing quotes from different insurance companies. Online comparison websites and insurance brokers can help you quickly and easily compare prices and coverage options. Make sure to consider factors like coverage limits, deductibles, and discounts when comparing quotes.

- Choose a Policy: After comparing quotes, choose the policy that best meets your needs and budget. Consider factors like the company's reputation, customer service, and claims handling process. Remember to review the policy details carefully before signing.

- Make Payment: Once you have selected a policy, you will need to make the first premium payment. You can usually pay online, by phone, or by mail. Some insurance companies also offer payment plans.

- Receive Confirmation: After making your payment, you will receive confirmation of your coverage. This confirmation will include your policy details, coverage limits, and payment information.

Negotiating with Insurance Agents

Negotiating with insurance agents can help you secure the best coverage at the right price.- Research and Prepare: Before meeting with an insurance agent, research different companies and coverage options. This will allow you to have a better understanding of your needs and make informed decisions. Prepare a list of questions and concerns you have about car insurance.

- Be Clear About Your Needs: Clearly communicate your needs and expectations to the insurance agent. Let them know your driving habits, vehicle usage, and budget. This will help them tailor a policy that meets your specific requirements.

- Compare Quotes and Coverage: Ask for quotes from different companies and compare them side-by-side. This will help you identify the best value for your money. Pay attention to coverage limits, deductibles, and discounts offered by each company.

- Negotiate Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, or multi-policy discounts. These discounts can significantly reduce your premiums.

- Don't Be Afraid to Walk Away: If you are not satisfied with the quote or coverage offered, do not be afraid to walk away. You can always shop around for a better deal. Remember, you have the power to choose the insurance company that best meets your needs.

Essential Documents and Information

When purchasing car insurance in Tennessee, having the following documents and information ready can streamline the process:- Driver's License: Your driver's license is a primary identification document required for all car insurance applications.

- Vehicle Registration: This document provides proof of vehicle ownership and registration, essential for insurance purposes.

- Vehicle Identification Number (VIN): The VIN is a unique identifier for your vehicle, helping insurance companies verify its details.

- Proof of Previous Insurance: If you have existing car insurance, provide proof of coverage to your new insurance company. This can demonstrate your responsible driving history and potentially qualify you for discounts.

- Driving History: Be prepared to share your driving history, including any accidents, violations, or suspensions. This information is crucial for insurance companies to assess your risk profile.

- Credit Report: In some cases, insurance companies may consider your credit score to determine your premiums. Be ready to provide information about your credit history if requested.

Tennessee Car Insurance Laws and Regulations: Tn Car Insurance Quotes

Tennessee has a set of laws and regulations governing car insurance, ensuring drivers are adequately protected and financially responsible. The Tennessee Department of Commerce and Insurance plays a crucial role in overseeing these regulations.Tennessee's Minimum Car Insurance Requirements

Tennessee requires all drivers to carry a minimum amount of car insurance, known as "liability coverage," to protect themselves and others from financial losses in case of an accident. This coverage is divided into two categories:- Bodily Injury Liability: This coverage protects you from financial responsibility for injuries to others in an accident. The minimum required coverage is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage protects you from financial responsibility for damages to other people's property in an accident. The minimum required coverage is $15,000 per accident.

Role of the Tennessee Department of Commerce and Insurance

The Tennessee Department of Commerce and Insurance (TDCI) is responsible for regulating the car insurance industry in the state. Its key responsibilities include:- Licensing and Oversight: The TDCI licenses and oversees insurance companies operating in Tennessee, ensuring they meet specific financial and operational standards.

- Consumer Protection: The TDCI protects consumers by investigating complaints, resolving disputes, and educating the public about their rights and responsibilities.

- Market Regulation: The TDCI monitors the car insurance market to ensure fair and competitive pricing, preventing unfair practices and ensuring the availability of affordable coverage.

Common Car Insurance Claims and Dispute Resolution

Common car insurance claims in Tennessee include:- Bodily Injury Claims: These claims involve injuries sustained by individuals in car accidents, including medical expenses, lost wages, and pain and suffering.

- Property Damage Claims: These claims involve damages to vehicles or other property in an accident, including repair costs or replacement values.

- Uninsured/Underinsured Motorist Claims: These claims arise when a driver involved in an accident is uninsured or has insufficient insurance coverage to cover the losses.

- Informal Resolution: The first step is to try to resolve the dispute directly with the insurance company.

- TDCI Mediation: If an informal resolution fails, you can file a complaint with the TDCI, which will attempt to mediate the dispute.

- Administrative Hearing: If mediation is unsuccessful, you can request an administrative hearing before a TDCI hearing officer.

- Court Action: As a final resort, you can file a lawsuit in court to resolve the dispute.

Finding the right car insurance in Tennessee requires careful consideration of your individual needs and circumstances. By understanding the factors that affect premiums, comparing quotes from different providers, and taking advantage of available discounts, you can secure the best coverage at a price that fits your budget. Remember, car insurance is a crucial investment in your financial well-being, providing peace of mind in case of accidents or unexpected events. With the right information and a proactive approach, you can find the perfect car insurance policy to meet your needs and protect your future.

Finding the right car insurance quote in Tennessee can be a bit of a challenge, but it's worth taking the time to compare options. If you're looking for ways to save money, consider learning about DIY air conditioning solutions, which can help you stay cool without breaking the bank. Check out this helpful guide for building a DIY Air Conditioner: Cool Down Your Home on a Budget.

Once you've got your home nice and cool, you can focus on finding the best car insurance deal for your needs.

Getting the best TN car insurance quotes can feel like a costume party in itself, with all the different options and details to consider. But just like putting together a creative costume, taking the time to compare quotes and understand your needs can lead to a great outcome. For inspiration on how to get creative with your own DIY projects, check out DIY Costumes: A Guide to Creative Costuming.

Once you've got your costume figured out, you can focus on getting the best car insurance quotes for your unique situation.

Post a Comment